Many Canadians argue that supply management should be eliminated because it drives up retail food prices. However, data from the last decade shows little evidence that supply management significantly increases food costs, though some caveats exist.

Using Statistics Canada’s database of selected food products, my team at the agri-food analytics lab at Dalhousie University analyzed the price increases of all food items from 2017 to the present. We compared the price increases of supply-managed products to the overall increase across all food categories.

The average price increase since 2017 for all categories has been 30.2 percent. Among supply-managed items, only three exceeded this average: cream at 30.9 percent, butter at 30.7 percent, and eggs at 37.9 percent.

Here are the rest of the supply-managed products: whole chicken: 17.5 percent, chicken breast: 20.1 percent, chicken thighs: 14.5 percent, chicken drumsticks: 1.9 percent, milk (one litre): 25.3 percent, milk (two litres): 25.9 percent, milk (four litres): 25.4 percent, cheese: 20.7 percent, yogurt: 27.1 percent. These are all below the average increase for all food products tracked by the federal agency.

This data underscores how specific supply-managed items have performed relative to the broader food market. Notably, products like butter, cream, butterfat products, and eggs are exceptions, having increased more than the average since 2017, but not by a significant margin.

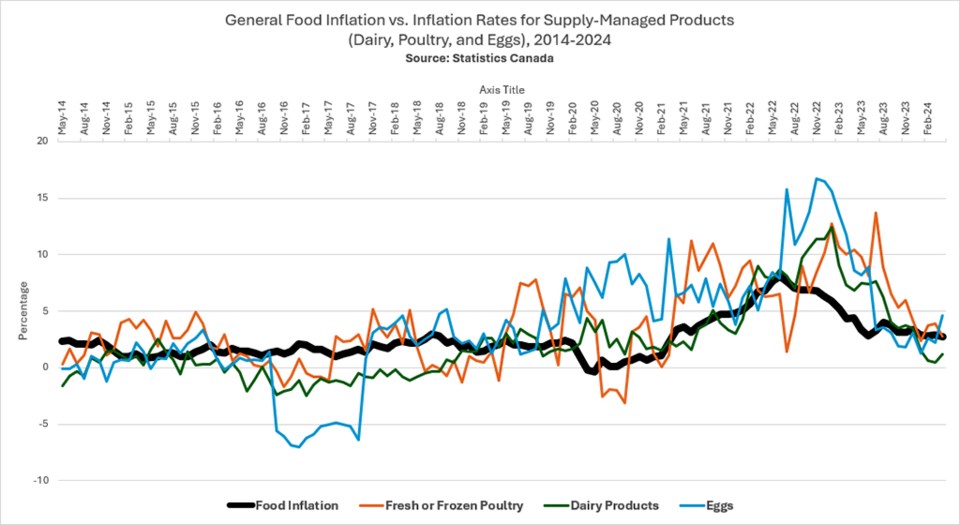

We also examined how supply-managed products have influenced food inflation over the last decade. The graph below shows the black line representing the overall food inflation rate. Compared to the lines representing supply management categories, there are no significant spikes or drops, indicating a stable inflation rate for general food items over the 10 years.

The fresh or frozen poultry (orange line) category shows more fluctuation compared to the general food line. Inflation rates for poultry have peaks and troughs, reaching as high as around 12 percent and dipping below -5 percent at times. This volatility is likely due to factors such as changes in feed prices, demand, or supply chain issues.

Dairy products (green line) display a moderate level of fluctuation but remain largely within a zero to 10 percent range. This suggests some stability but with periodic adjustments, possibly influenced by production costs or market demand. Finally, eggs (blue line) exhibit the most volatility among the categories shown. The inflation rate for eggs peaks at over 20 percent and has sharp declines, including a significant drop below -5 percent. This could be due to factors such as avian influenza outbreaks, which historically impact egg production and prices.

Based on the evidence over the last decade, it is hard to conclude that supply-managed products have significantly exacerbated the cost of food for Canadians. However, there is still cause for concern.

Supply-managed food categories, especially eggs, appear to fluctuate as much or more than many other food products. While supply management aspires to stabilize prices, the data suggests otherwise. Therefore, while it’s not entirely fair to claim that supply management consistently drives food inflation higher, it does seem to occasionally contribute to higher prices.

The latest CPI report from Statistics Canada indicates that month-to-month increases for dairy, poultry, and eggs are much higher than the average for April. Price volatility is a significant reason Canadians perceive a food category as expensive, and supply management is not preventing that from happening.

Additionally, our analysis covers only 10 years and doesn’t consider that supply-managed product prices may have been higher when compared to other categories. Anecdotal evidence suggests these products tend to be cheaper in other parts of the world, including the United States.

Beyond price volatility, supply management inflates prices for processors, particularly dairy, which, in turn, suppresses innovation up the food chain. Our discussions with dairy processors indicate that industrial milk in Canada is much too expensive. In fact, industrial milk prices in Canada are the highest in the industrial world.

For supply management to better serve Canadians, reducing retail price volatility and lowering industrial prices should be key objectives for policymakers.

Dr. Sylvain Charlebois is senior director of the agri-food analytics lab and a professor in food distribution and policy at Dalhousie University.

©