The pipelines connecting southeast Saskatchewan and southwest Manitoba’s oil wells to market have changed hands a few times during the years, but it’s been a generation since that last happened. The difference this time is that instead of С����Ƶ amalgamated into a larger company, it’s been spun off and purchased by a smaller company. However, in the end, the marketing options for all involved may be a lot greater than they have been in the past.

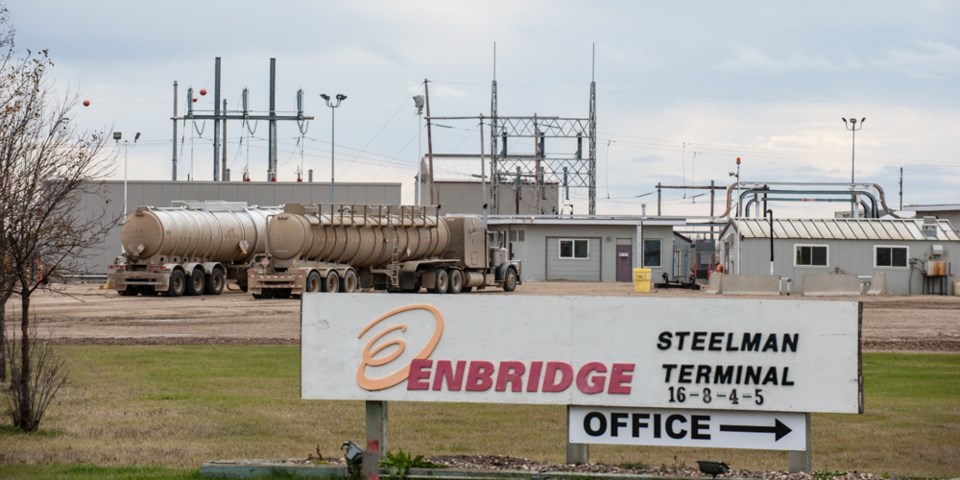

On Sept. 29, Tundra Energy Marketing Limited (TEML) announced its planned acquisition of Enbridge’s С����Ƶeast Saskatchewan Pipeline System, previously known as Enbridge Pipelines (Saskatchewan) Inc., or EPSI.

While TEML president Bryan Lankester declined to comment about potential future connections to TransCanada’s proposed Energy East project, we can draw our own conclusions.

With TEML’s purchase of the EPSI system, combined with the potential of the Energy East project, oil producers in southeast Saskatchewan and southwest Manitoba would have a full suite of shipping options, as well as storage.

If Energy East does go through, and its planned Cromer Lateral pipeline goes ahead, an oil producer in this region would have dramatically more options than they had, say, six years ago. They could use the Enbridge mainline, shipping into the American PADD II market, as has been the case for generations. Or they could choose to ship to Eastern Canada, via the Cromer Lateral and Energy East, thus allowing for usage in Canadian refineries. Or they could choose to ship to the East Coast of the U.S. via barge or tanker from Saint John, New Brunswick, or even overseas via tanker.

Their third option, when the economics present themselves, will be the use of the substantial crude-by-rail facility TEML built near Cromer a few years ago. Capable of loading unit trains, and connected by pipeline to the Cromer complex, any oil shipped into Cromer via the gathering system could potentially be loaded onto rail cars and shipped anywhere in North America.

This last option presumably makes crude-by-rail a little easier for any producer already connected by pipe, meaning that, potentially, anyone would be able to ship by rail, not just those with a rail loading facility nearby. It also means if you were a trucking firm whose business gained from the influx of crude-by-rail a few years ago, you might not be able to count on it again when the economics for rail shipments improve.

While Enbridge now characterized these assets as “non-core,” for TEML, this will be the heart of their business. It dramatically increases the scope and scale of their business as a midstream pipeline operator.

Will this sale actually change much for the people on the ground? No. But for producers, with new options for crude-by-rail (when the price supports it,) and possible connection to Energy East (if it is ever built), it could mean a better bottom line, improving the business for all involved.