A few months ago, Pipeline News obtained a copy of the overview of the bid package that Crescent Point Energy Corp. put out as it seeks to sell off roughly 21,000 boepd of production in southeast Saskatchewan and southwest Manitoba.

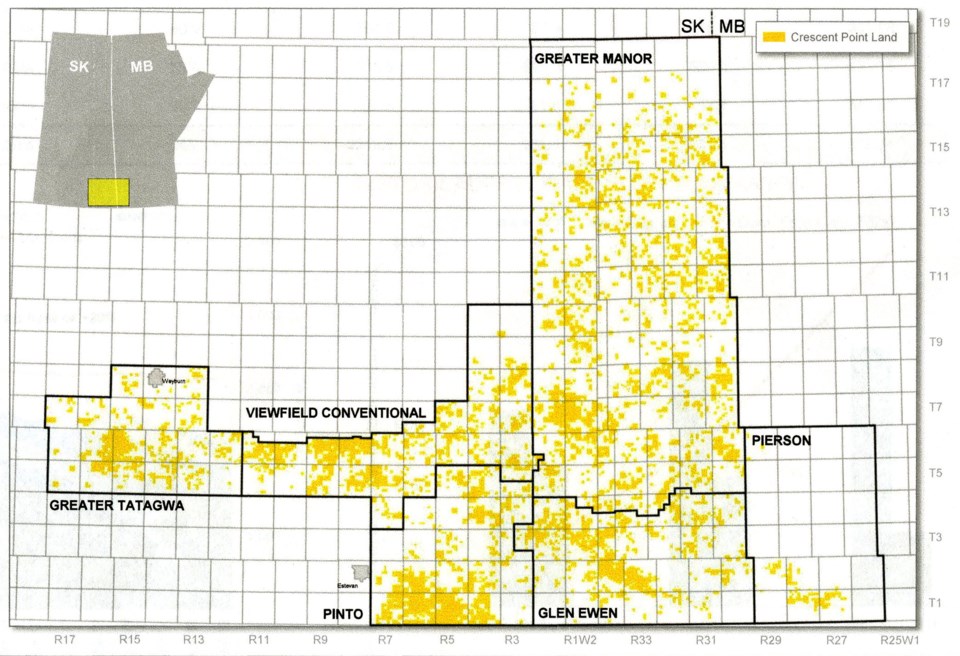

The package includes six parcels, five in southeast Saskatchewan and one in southwest Manitoba. Basically, it appears that everything that is not the Viewfield Bakken (around Stoughton) or Flat Lake (around Oungre-Torquay) is up for sale. That’s a lot.

We’ve sat on this information for a while, waiting to see what would happen. While we’ve heard many rumours from numerous people that some deals might be close, but when Crescent Point held its first quarter earnings call on May 9, there was no reference to any sales. Thus, the sales process seems to be ongoing.

It’s evident that Crescent Point has been disposing of assets for a while now. We were astonished, back in the summer of 2017, when we heard that Corex had bought some properties in Manitoba. Up until that point, it was almost a truism – Crescent Point didn’t sell, anything, ever, at least in this neck of the woods. But indeed they had. And later, Torc Oil & Gas bought some of Crescent Point’s production as well.

But that was before this bid package was announced. This is a big deal.

That’s because, for the better part of a decade, the business model for much of southeast Saskatchewan was for small junior oil producers to fire up, build up their production, and then sell. Most of the time, that sale was to Crescent Point.

You could usually tell when another noticeable sale was coming up, because Crescent Point would put out a press release referring to bought-deal financing. For example, an Oct. 13, 2014 press release announced the completion of a $375 million bought deal financing. Another examples was on Sept. 24, 2014, when another $750 million in bought deal financing was announced, at $43.40 per share. To list all the examples would probably fill this page, but you get the idea.

That 2014 example is perhaps telling, because Crescent Point stock was soaring, and the downturn had started, but no one really knew it yet. Oil was US$93.54 on Sept. 26, 2014, and it plummeted from there. We have not yet come close to returning to those dizzying heights.

Along the way, Crescent Point surpassed even mighty Husky Energy to become the largest oil producer in Saskatchewan.

All this is to say that building up a small oil company, it was a pretty safe bet at some point you would have a “liquidity event” and be “taken out” by Crescent Point. Champagne corks all around.

This sale of those six parcels is effectively the partial breakup of Crescent Point. This isn’t just the sale of a few “non-core” pieces. This is a big deal.

This sale is going on because Crescent Point is under pressure to dramatically reduce its debt. Hopefully it will come out much stronger in the end, and in a few years, again be in a position of strength. We must keep this in perspective. Even if it does sell 21,000 bpd of production, and is successful in its other sales of reaching its goal of disposing of a total of 50,000 boepd, that still leaves the company with around 124,000 boepd.

But in the meantime, what will be the business model, going forward? For one, a few people with knowledge of the sale have told us the parcels for sale are too big. Two of those pieces are in the range of 6,000 boepd. Three others range from 2,400 to 3,560 boepd. Those are way too big for small juniors to pick up and develop, unless we see some sort of consortiums come together, with the intention of splitting them up afterwards.

These parcel sizes mean that the most likely buyers will need to be intermediate producers in scale. There’s a few of those operating in southeast Saskatchewan whose names spring to mind. There’s always the possibility that an outside company could jump into the region as well, although, given the flight of companies and capital from the Canadian oilpatch, don’t bet on it.

One thing you will hear from almost every service company is that they welcome the idea of having more potential clients to work for. The reality is, when you get to be as big and influential as Crescent Point has become, the region becomes something of a “company town.” If a substantial portion of your fleet isn’t working for Crescent Point, it’s not working.

During the downturn, when other companies tightened their purse strings even more, that became doubly the case. Crescent Point often led the entire nation in active drilling rig numbers. They were spending some money, and keeping some activity going, while others were holding their cards close to their chests.

Consider this: if you are going to buy a property, it’s not likely you’re going to sit on your hands. You’ll want to do something with it. Crescent Point hasn’t done much drilling in these areas for a while now. New owners will likely mean new development.

So what is the oil company business model going forward in southeast Saskatchewan? Does a large oil company swoop in and buy the whole package, lock stock and barrel? We’ve heard that’s unlikely. Do we see a handful of already-active intermediates take a chunk here and there? Will we see the rise of the junior oil producer again?

And if we do, what is their strategy? How do they plan for an exit, a liquidity event? Who will be the buyer? One of the intermediates?

Or will they have to adopt the model of some of the family-owned oil companies, quietly producing for decades, with no intention of selling out anytime soon? It’s hard to get investors excited about that. They like having a reason to pop the cork on their champagne bottles.

Whatever the change will be, and whenever it comes, Crescent Point’s sale of these six parcels will substantially shake up southeast Saskatchewan. Keep your eyes open. There may be opportunity there.