If this year wasn’t bad enough for the oilpatch, next year’s drilling activity is expected to be even worse, with substantially fewer wells drilled across the country. That includes Saskatchewan, which is projected to drill less than a quarter of the wells in 2021 than it did in 2014.

That’s according to the Petroleum Services Association of Canada (PSAC), which released its 2021 forecast via Zoom call Thursday from Calgary.

PSAC interim president and CEO Elizabeth Aquin was joined by Ben Brunnen from the Canadian Association of Petroleum Producers (CAPP), John Gibson from BMO Capital Markets, Rowena Gunn from Wood Mackenzie, and Bemal Mehta from JWN Energy.

The presentation reflected on the year to date, the worst in living memory in the oilpatch, and what is expected for next year and the following years.

“All in all, it has been a dismal year for the industry in general and for the oilfield services sector, in particular, that bears the brunt of the downturns earlier than our customers, laying off valuable employees sooner from lack of work, cost pressures and liquidity challenges,” Aquin said. “We've seen, as others have mentioned, capital budgets have been slashed from the demand destruction of the pandemic, low commodity prices that this year fell into negative territory for the first time ever, and the continued protests and legal challenges over critical infrastructure that would give us access to the much needed global markets, continued uncertainty from federal policies and capital investments that are now threatened by the new ESG (environmental, social and corporate governance) culture that questions investments in fossil fuels.”

“And, of course, we know that the results of the U.S. election next week will also have an impact on us one way or the other. Whether for better and for worse remains to be seen.”

In the final presidential debate, Democrat presidential candidate Joe Biden said he intends to “transition away from the oil industry, yes.” But when asked why none of the five presentations factored in the possibility of a Democrat Joe Biden presidency, Brunnen responded, “The speculation on the U.S. presidential elections is always a little difficult. I recall, when we had Trump get elected, there was all kinds of discussion on what he was going to do – border adjustment tax and what and whatnot. And so, we did spend a heck of a lot of time actually looking at that. It turned out to be quite different than what actually was sort of discussed during the campaign. And so that's a little bit why I didn't really raise any commentary on this is, it’s just the speculation has to much uncertainty surrounding it.”

He said demand is still expected to be robust in the near term.

Gibson said in 2020 global oil demand had dropped by one of the largest amounts, ever.

“It fell by around 17 million barrels per day in Q2 to around 83 million barrels per day,” he said. “Given the steep drop in global drilling activity, we anticipate year over year decline in production of about six million barrels per day to 95 million barrels per day by year end 2020. So overall, we expect to supply overhang to keep the cap on oil related activity levels until at least the back half of 2021.”

He said at US$30 per barrel for West Texas Intermediate (WTI), production is shut in. At US$40 WTI, the range it is right now, the industry is in more of the maintenance activity level. At US$50 WTI, producers will be more confident and put additional equipment back in the field.

“Personally, any guesses as to when demand is going to come back are purely just that right now – just guesses,” Gibson said. “Until we start seeing a vaccine (for COVID-19), or something along those lines, I’m not sure we can even start talking about timelines for recovery.”

The drilling forecast was based on assumptions of average oil price of US$42 per barrel for WTI, $2.50 per thousand cubic feet for AECO gas, and a Canadian dollar worth 76 cents US.

The forecast for 2020 as the year wraps up is 2,850 wells drilled. For 2021, the expectation is 2,600, a decline of 250 wells for the entire country.

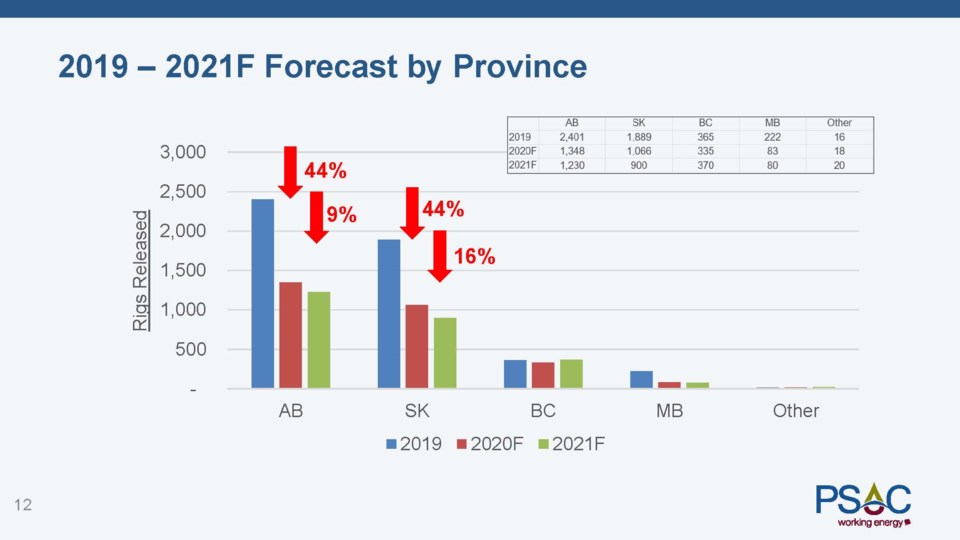

For Saskatchewan, there were 1,889 wells drilled in 2019. The forecast for 2020 is 1,066 wells, a decline of 44 per cent. Most of those wells had been drilled in the first quarter. For 2021, the forecast is just 900 wells, a decline of a further 16 per cent from an already devastating 2020. For reference, there were 3,665 wells drilled in Saskatchewan in 2014.

Alberta is expected to see similar declines, dropping from 2,401 wells in 2019, to a forecast of 1,348 for 2020, and 1,230 for 2020. Put another way, Alberta, whose oilpatch is multiple times larger than that of Saskatchewan, is expected to drill one third fewer wells in 2021 than Saskatchewan did in 2019, and that was a comparatively poor year for Saskatchewan.

Part of this is the dramatic increase in drilling rig efficiency, with rigs generally producing three times as much as they did five years ago. Mergers and acquisitions mean that five drilling companies now do 80 per cent of all drilling in Canada.

An important consideration is the length of wells, or meterage. Aquin noted that from 2014 to 2021, wellbores have grown, on average, 40 per cent longer.

In Saskatchewan, the average is now over 2,000 metres. But total meterage has declined from over 25 million metres in 2014 to just over eight million in 2020, “a massive 67 per cent decrease in just six years,” Aquin said. That’s brought total meterage “down to levels not seen in recent history.”

The need for crude-by-rail is expected to drop to zero next year, according to Brunnen.

Aquin noted some service companies have benefited from the $1.72 billion well abandonment program to close orphan and inactive wells. She noted the work has been challenging and slower than hoped for; PSAC is projecting just over $450 million to be spent on well abandonments in 2020, and just under $700 million in 2021. All the funds must be used by 2022. The work in Saskatchewan is expected to double from this year to next.

“On a positive note we've again already started to see some beginnings of recovery coming in Q3. So rig rates have started to increase,” Gunn said.

Regarding how Saskatchewan is doing, Gunn, replied in an email, “So we’ve seen Saskatchewan hit hard by the recent crash, in part because it is so heavily liquids weighted and the current environment has been a challenge.

“We do forecast cashflow for 2020 to remain positive but there has been deep implications for production. On average across Canada, we expect 2020 production to fall about three to four per cent, for Saskatchewan that’s much higher, at about 12 per cent. Although we expect production will recover over the next few years, Saskatchewan is the only region where we do not forecast production to ever reach 2019 highs again.

“However, just to frame that a bit, by 2025, we expect it to be pretty close, only 1-2 per cent off 2019 production levels.

“We do see some growth in heavy oil in the region, partially from thermal projects that were operated by Husky prior to the Cenovus/Husky merger, however we don’t really see any other big wedge of growth. Some of the past growth has been driven by the Viking, but these wells have relatively short lives so additional drilling is required and most of the top tier locations have already been drilled.

“The government has done a lot of work to improve their regulatory framework, but the one of the biggest challenges may come from methane emission restrictions and other ESG measures as currently Saskatchewan is the ‘worst’ emitter in Canada.”

Aquin concluded, “This is not the kind of news our members would be hoping for.”