Regina– Just what are junior producers, and how important are they to Saskatchewan’s oilpatch?

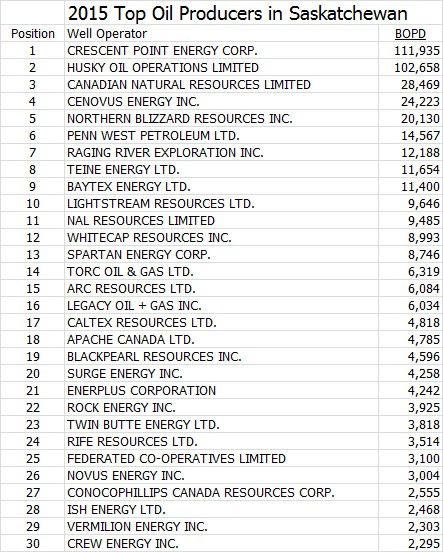

Saskatchewan’s oil production, according to figures obtained from the Ministry of the Economy, shows that two companies, Crescent Point Energy Corp, and Husky Oil Operations Ltd., dominate our oilpatch, with average daily production of 111,935 and 102,658 barrels of oil per day, respectively.

There’s a big drop to number three, Canadian Natural Resources Limited, at 28,469 bopd. The next slots of the top ten are Cenovus Energy Inc. (24,223), Northern Blizzard Resources Inc. (20,130) and Penn West Petroleum Ltd. (14,567). But that’s when we start getting into junior producers that have grown into what are, technically, considered intermediate producers – Raging River Exploration (12,188) and Teine Energy Ltd. (11,654), both active players in the Kindersley area. Baytex Energy Ltd (11,400) Lightstream Resources Ltd. (9,646) round out the top ten.

Assistant Deputy Minister Ed Dancsok, senior strategic lead for Petroleum and Natural Gas Development in Saskatchewan’s Ministry of the Economy, explained that an intermediate producer is a company whose production averages between 10,000 and 200,000 barrels of oil equivalent per day, company-wide.

In other words, you don’t have to go down very far on the list of oil producers in this province to get into what are considered “junior producers,” especially when you consider there are over 500 licensed producers in Saskatchewan. Sure, a few, like Apache Canada (4,785) and ConocoPhillips Canada Resources Corp. (2,555), obviously have more production elsewhere. But for the vast majority of the oil companies operating in Saskatchewan, small operations are the order of the day.

Terms like “junior” and “intermediate” are often used in the news and investment community, but to the government, they’re all the same.

“We treat all companies the same – big, medium or small,” Dancsok said. “The oil industry in Saskatchewan was built on the backs of junior companies. They are more nimble and able to move into areas and develop plays and fields at a quicker pace, making themselves attractive to larger companies to swallow them up. That’s been the genesis of southeast Saskatchewan, (and the) southwest and Kindersley area that have these smaller companies. They become attractive and a bigger company buys their production.”

С����Ƶeast Saskatchewan used to have a number of major oil companies like Shell, Imperial Oil and British American Oil (Tin toy trucks with the B/A logo could be seen at a recent toy show in Yorkton, for instance.) However, over the years, these companies have left the region.

“There’s a lot of family-run operations in southeast Saskatchewan. They keep on working away. Their production doesn’t get too big, but they keep surviving.”

Junior producers, like other oil companies, have been feeling the heat from the downturn. However, there haven’t been as many companies shutting down as Dancsok said he might expect, given the circumstances.

“It’s always a time thing. You can maybe weather the storm for six months, maybe a year. We’re 18 months into the cycle now. Sooner or later, the chickens come home to roost,” Dancsok said.

Different juniors are prominent in each area of the province. In the northwest, Black Pearl and Rock Energy are two of the active players. Rife Resources is another, according to Dancsok. Rife is controlled by a pension fund for railroad employees, and has been around for decades.

“They keep plugging away. Black Pearl is one. They’re working at the Onion Lake reserve. They’re up to 4,500 barrels per day,” he said.

In the Kindersley area Teine and Raging River have been two of the most active drillers, often having two drilling rigs each, according to Rig Locator (riglocator.ca). Dancsok noted they are in a growth mode, and have grown well over the 10,000 barrel per day threshold. “They were juniors at one time. I think we almost have to call them intermediate companies now.”

In the southwest, Surge Energy is one of the few companies, besides Crescent Point, that has still been drilling over the last year, according to Rig Locator. Surge sold much of its southeast production to Torc Oil and Gas over the past year.

Jarrod Oils is a local southwest company with a long history, he noted.

In the southeast, Midale Petroleums had been climbing the list of producers, but divested about half of its production in the past year.

Several small southeast oil companies have told Pipeline News over the last month that they are actually looking for opportunities during this down cycle.

“When I talk to some of these guys, they stick to their bread and butter kind of plays. They don’t get extravagant and chase the Bakken or higher cost plays. They stick to the good old, reliable, the straightforward Mississippian plays they know. They know their locations, they know their techniques. They’re not doing too bad at all. Steady as she goes. They might not make as much money as before, but they’re still making money.”

Dancsok noted that many of these oil companies have been doing cost cutting. They have been through downturns before, and know how to adjust and find efficiencies.

“One of them said to me the other day that $50 dollar oil will become the new $100 oil,” Dancsok recalled.

Service companies have reduced their prices, he noted, but acknowledged that the price for electricity from SaskPower to run pumpjacks is not going down.

“There’s going to be casualties. You know there are. I hate to be harsh about it, but sometimes the pruning of the bad wood overall is good for the overall industry. It’s a harsh thing to say. It’s people’s livelihood and investment. People can lose a lot over it. But it happens in any sector, with any kind of downturn. Companies that were weak to begin with just can’t weather the storm as well as some that are better positioned and strategic about how they move forward,” he said.

One of the casualties has been the business model to build small junior producers quickly and then flip them. However, with the current price of oil, Dancsok thinks build-and-flip is on its way out. He noted that on the regulatory side, those companies have been problematic in the past, cutting corners to get production up.

SHOP

In recent years, a few southeast oil producers have banded together into their own industry association, Saskatchewan Headquartered Oil Producers, or SHOP.

Dancsok noted that when Small Explorers and Producers Association of Canada dropped the “small” portion of their name, those producers that are now part of SHOP felt they needed their own organization.

“When we do our industry consultations, such as through the development of IRIS (Integrated Resource Information System), we included SHOP in all those efforts,” he said. “It’s good to hear from CAPP, it’s good to hear from the intermediates, from EPAC, but we always include SHOP in our deliberations as well.

“They’re the pragmatic guys, boots on the ground, let's get ’er done crowd. Sometimes they’ve got some pretty pragmatic, common sense solutions to things we’re trying to walk through.”

SHOP has concerns with Saskatchewan adopting and, essentially, rubber-stamping many Alberta regulations. Asked if there’s too much Alberta influence within the ministry, Dancsok said, “We struggled with that. We certainly had that as part of our thought process bringing this in.

“I was just in Calgary, talking about this very thing, the new directives we’re bringing in. They’re modelled on Alberta, but they certainly have a Saskatchewan slant to them. That is because of the feedback from the Del Mondors and some of the others.”

Del Mondor is owner of Aldon Oils and a SHOP member.

Dancsok continued, “We certainly have to modernize our regulatory framework. Some of that is around ‘why reinvent the wheel?’ Alberta is there. They’ve got this stuff developed there and accepted by industry. In Saskatchewan, we recognize we’re not Alberta, and we have a different flavour of operators, both large and small. I think we took care to have a Saskatchewan flavour to these regulations.”

An example he used is the new Directive 17, which covers oil and gas systems and measurements. It will be implemented on April 1.