(Daily Oil Bulletin) Calgary – Crescent Point Energy Corp.’s consolidation of southeast Saskatchewan oil production continues, as the company has entered into an arrangement agreement to acquire all of the issued and outstanding shares of Legacy Oil + Gas Inc.

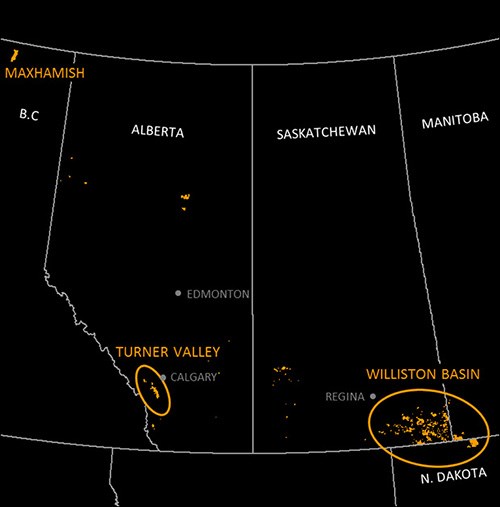

Legacy is a publicly-traded, light oil-weighted producer with approximately 22,000 boepd of high-netback production, of which more than 15,000 boepd is from conventional and unconventional plays in Crescent Point's core southeast Saskatchewan, Manitoba and North Dakota areas.

Legacy had been led by a management team headed by Trent Yanko. It has been an early mover in the Torquay play along the U.S. border, and has done extensive work in the North Portal area.

The assets to be acquired include approximately 1,000 net sections of land, of which approximately 525 net sections are in southeast Saskatchewan. The southeast Saskatchewan lands include approximately 200 net sections in the emerging and highly-economic Midale light oil resource play.

Total consideration for the Legacy arrangement is approximately $1.53 billion, comprised of approximately 18.97 million Crescent Point common shares and the assumption of approximately $967 million of net debt, estimated as at the time of closing and inclusive of transaction costs.

“The Legacy acquisition is aligned with our strategy of acquiring large oil-in-place pools with low current recovery factors,” said Scott Saxberg, president and CEO of Crescent Point. “This acquisition improves the long-term sustainability of our business model and our dividend not only through financial accretion and a lower payout ratio, but through the addition of a mix of assets with significant growth potential, low-decline rates and waterflood potential. The low-cost, high-return Midale assets add yet another layer of top-quartile locations to our drilling inventory and provide us with additional operational flexibility.”

Assuming the successful completion of the Legacy arrangement on or about June 30, 2015, Crescent Point is upwardly revising its 2015 guidance for production and capital expenditures.

The company's 2015 average daily production rate is expected to increase by approximately 6.6 per cent to 162,500 boepd from 152,500 boepd, which is based on average second half 2015 production of approximately 20,000 boepd from the Legacy assets.

Capital expenditures for the year are expected to increase by $100 million to $1.55 billion. Approximately 65 per cent of the incremental capital expenditures is expected to be directed towards drilling and completions, with the remainder used for facilities and land investments. Crescent Point expects to revisit its capital budget during third quarter 2015 based on the company's continued efforts to improve overall capital costs and efficiencies, as well as its outlook for commodity prices.