Calgary – There’s a lot of buzz going around southeast Saskatchewan, as Crescent Point Energy Corp. put up for sale six significant tracts of properties earlier this year, after a decade of serial acquisition. While no sales were announced during the Crescent Point first quarter financials announcement on May 9, there’s plenty of anticipation of something coming up one of these days.

Pipeline Newsobtained a copy of the company’s “СŔ¶ĘÓƵeast Saskatchewan Light Oil Portfolio Offering” earlier this year, which listed National Bank and Scotiabank as the two banks involved.

The document says there are ~21,625 boepd of predominantly Mississippian light oil for sale, with over 100 mmboe of 2P reserves across ~800 net sections of land. There is a high working interest of 86 per cent in primarily operated production.

As of the week of Dec. 23-29, 2018, the properties had 20,099 boepd in production, of which 90 per cent was oil and liquids, and a base production decline of 20 per cent. The annualized net operating income is $255 million, with operating netbacks of $32.35 per boe.

The total offering includes over 1,560 identified drilling locations, with over 500 booked. Crescent Point says there is development potential across multiple producing zones, and significant seismic coverage over the land base providing validation.

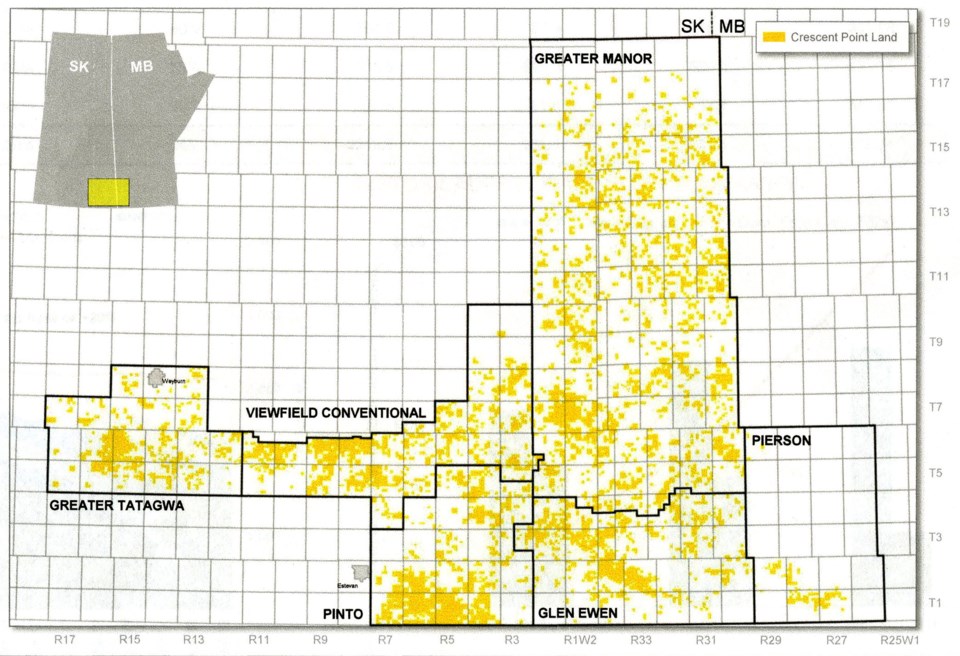

The offering is divided into six areas, five in southeast Saskatchewan, and one in the extreme southwest corner of Manitoba, referred to as “Pierson.”

In making the initial announcement back in October that the company would be retaining and focusing on its Viewfield Bakken, Flat Lake and Shaunavon plays (Shaunavon СŔ¶ĘÓƵ in southwest Saskatchewan), this is born out in the offering.

Basically, almost everything east of Highway 47, except for part of the Viewfield Bakken around Forget and Kisbey, is for sale. There’s also a portion south of Weyburn.

The maps included in the documents show that pretty much everything in southeast Saskatchewan that is not part of the Viewfield Bakken of Flat Lake plays is up for grabs.

Greater Tatagwa Ěý

Starting from the west is the “Greater Tatagwa,” which appears to include property in the Weyburn Unit. This parcel is six townships east to west, from Range 12W2 to Range 17W2, and up to four townships south to north, from Township 5 to Township 8, with Weyburn at the top. Greater Tatagwa is listed as having 2,498 boepd of production, of which 100 per cent is oil and NGLs.

There are 70 drilling targets listed, all in the Midale formation.

Viewfield Conventional

Working eastward is a narrow band referred to as “Viewfield Conventional.” Its production is pegged at 3,065 boepd, of which 97 per cent is oil and NGLs.

This band is roughly two townships wide, from north to south, and runs between the Viewfield conventional and Flat Lake in its western portion. Much of this portion falls along Township 5 and 6. The eastern portion hooks to the northeast, going to Township 10.

This area had 249 potential drilling targets, 116 Midale and 126 Frobisher/Alida.

Pinto

The “Pinto” area runs from just east of Estevan for five townships to Range 3W2, and from the U.S. border north for up to five townships to Township 5. This is the largest production volume area, but the one with the lowest oil fraction. Pinto is listed as having 6,150 boepd, but only 73 per cent of that is oil and NGLs.

The Pinto area has, by far, the largest number of potential drilling targets listed at 719. That’s broken down into 438 Midale, 28 Frobisher/Alida, 43 Bakken and 210 Torquay targets.

To the east of that, running along the U.S. border to the Manitoba border is “Glen Ewen.” Its production is pegged at 3,562 boepd, with a 91 per cent oil and NGL ratio. This portion is seven townships east to west, from the Manitoba border to Range 2W2, and four townships south to north, from the U.S. border to Township 4.

Greater Manor

The last portion in southeast Saskatchewan is also the largest. “Greater Manor” runs a little over 14 townships north to south, from Township 4 to Township 18. It runs six townships from east to west, from Range 30W1 to Range 2W2.

Greater Manor has the second highest volume of all, with 5,715 boepd, of which 97 per cent is oil and NGLs. This region has the most diversity of targets, with five potential formations to drill into for a total of 281 targets. The Amaranth has 66 targets, 40 in Frobisher/Alida, 84 in the Tilston, 29 in the Bakken, and 30 in the Torquay.

Pierson

The aforementioned Pierson centres around that Manitoba village, and runs from the U.S. border to Township 6, and is four townships wide, from the Saskatchewan border to Range 26W1.

The Pierson area has 64 identified targets in the Amaranth formation.

Big parcels

Notably, with the exception of the Pierson parcel, most of these parcels are substantially larger in volume than when they were acquired piecemeal over the years. Several people with knowledge of this offering expressed concern to Pipeline News that they may be too big for smaller companies to acquire, limiting the potential buyers to larger firms.

Also notable is the fact most of the land in the region close to the Carlyle field office is up for sale.

Ěý

Crescent Point supports oil show, replies to questions about transition plan

Pipeline News asked Crescent Point via email for comment about upcoming Saskatchewan Oil and Gas Show in Weyburn, as well as this current property sale, with the understanding it is still in process. The company responded on May 17, stating, “Crescent Point is proud to support the communities in which we operate as well as the Saskatchewan Oil & Gas Show. This year, we are volunteering at the show, sponsoring a lunch and are proud that one of our team members is on the Saskatchewan Oil & Gas Show board. We encourage our employees to attend this event because it is a great opportunity to build professional relationships, meet with vendors and learn about new technologies.

“Saskatchewan remains Crescent Point’s largest operating area, with its three key focus areas all located within the province. These plays, which include Viewfield, Shaunavon and Flat Lake, provide attractive returns, free cash flow, long-term scalability and reliable market access. These positive criteria supported our decision to allocate more capital to these resource plays in 2019.

“Since announcing our transition plan to become a more focused and efficient company with a stronger balance sheet in late 2018, our team has worked diligently to improve our company’s financial position through disciplined capital allocation and cost reductions. Our management team is also progressing its asset disposition process, which it initiated during first quarter 2019.

“Crescent Point is working to become a stronger company to ensure our company, employees, Saskatchewan residents, investors and community partners can all benefit from the responsible and safe development of Saskatchewan’s vast resources.”

Ěý