Edmonton, Regina – On Dec. 2, Alberta Premier Rachel Notley announced that her province would be temporarily curtailing oil production by 325,000 barrels per day (bpd) in address the province’s current storage glut, a result of insufficient takeaway capacity via pipelines. The result has been oil prices for Western Canadian Select so low the province’s energy resources are “С����Ƶ sold for pennies on the dollar,” according to the premier.

Four days earlier, Notley announced the province would be buying up to 80 locomotives and 7,000 rail cars as the first measure to address the glut. The curtailment is the second, an idea put forward by the leader of the opposition.

While Notley did not refer to Saskatchewan in her remarks, the opposition leader, United Conservative Party Leader Jason Kenney, did. In supporting the curtailment move, Kenny called on the Alberta government “ask that (Saskatchewan) follow suit. Saskatchewan produces a significant share of Canadian oil.”

He noted that southeast Saskatchewan oil, in particular the Bakken, is not affected by the same price differentials. “But we would hope that producers outside of Alberta would understand they need to be part of the solution in saving jobs.”

To that end, Saskatchewan Premier Scott Moe responded on Dec. 3, saying in an emailed statement, “The action taken by the Government of Alberta to cut oil production in the face of an unacceptably high differential for Western Canada Select oil reflects the crisis that Western Canada's energy sector has faced for far too long. The clear failure of the federal government to build pipelines and ensure market access for our energy products has had a great cost on the economy and the people of Saskatchewan.

“While Saskatchewan understands the action taken by our neighbours in Alberta to reduce the oil glut that is depressing the Western Canada Select oil price, the impact of the differential and how it is spread across our energy sector represents a different challenge to our province.

“Our oil production and market for our product is significantly different than Alberta’s. Saskatchewan has no oil sands in active production and we are more diverse in what we produce. Further, roughly 60 per cent of the oil produced in Saskatchewan is a range of light and medium oil. For these reasons, a government-mandated production cut in Saskatchewan could result in a loss of jobs and economic activity in our province, but would have little impact on the price of oil because it would disproportionately impact conventional oil production, which is not the problem.

“That said, we understand the actions С����Ƶ taken in Alberta and will be working with our industry partners to ensure Saskatchewan is not undermining these efforts.

“This crisis has cost Western Canada's energy industry billions in lost growth, and far too many families their livelihoods. Saskatchewan will continue to work with our provincial counterparts and advocate for the federal government to create a long-term solution to this crisis by getting pipelines built so we can sell our oil for what it is worth,” Moe said.

Speaking to reporters in Regina, he added, “We have consulted closely with industry and we continue to. The Minister of Energy will be meeting with our industry leaders, again, all of them. In the short period of time the invitation has been extended, to ensure that we are taking action where we can, effective action. We will continue to work with the industry through what is a crisis, been identified by the prime minister as a crisis, and I think it’s something we’ve been talking about for some time.

“Saskatchewan is also feeling the effect of the price differential here in the province to a great degree. It’s costing our industry, not only employment opportunities, but its costing investment opportunities in the province. So we are feeling the effect of the oil differential, but the curtailment, in Saskatchewan, from the advice we’ve received, from the industry, just will not be effective.”

He said the province will be moving forward on opportunities to ensure the industry is viable and sustainable in the long term and into the future. That announcement would be with industry. When asked if it would be this week, he said, “Believe so.”

He alluded that the impending announcement would drive the cost of production down, and that this has been planned for some time.

Moe laid the blame for the current situation at the federal government’s feet, for the demise of the Northern Gateway and Energy East projects, as well as Bill C-69.

If Saskatchewan did cut production

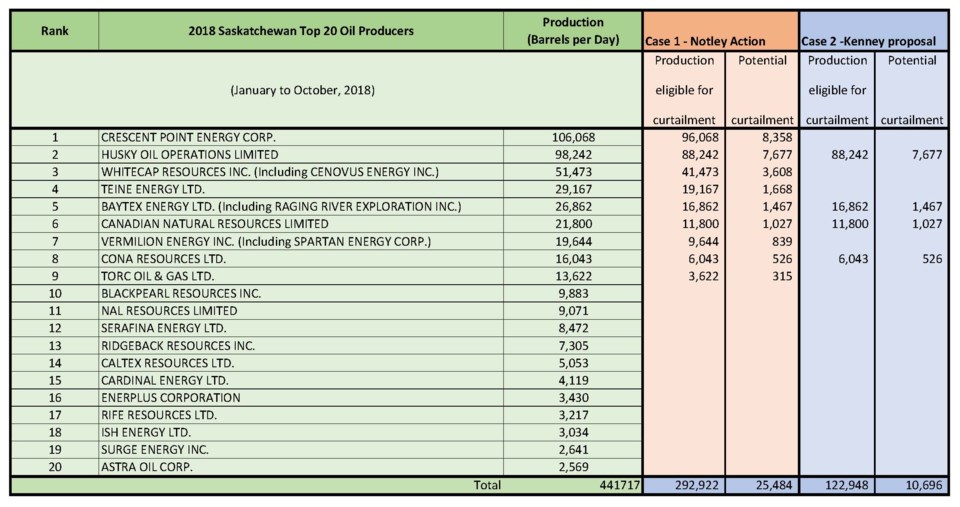

How much production would be affected if Saskatchewan did implement cuts in a similar manner to Alberta? Pipeline Newsobtained recent data from the Ministry of Energy and Resources listing the top 20 oil producers in Saskatchewan, based on their January to October oil production in barrels per day.

Those top 20 producers account for the vast majority of Saskatchewan’s oil production, totaling 441,717 bpd amongst them.

Only nine producers were over the 10,000 bpd production level which Alberta is exempting from production curtailment. If Saskatchewan followed the Alberta model, and all producers over 10,000 bpd were curtailed by 8.7 per cent, the total curtailment would total 25,484 bpd. Most of that would come from producers which don’t even produce the heavy oil affected by the differentials in question. For instance, Crescent Point Energy Corp., which produces 106,068 bpd, would be forced to curtail 8,358 bpd, and they don’t produce heavy oil.

In the second case, where Kenney proposed that areas like the Bakken in southeast Saskatchewan be excluded, that would mean that only Husky Energy, Baytex Energy, Canadian Natural Resources Limited (CNRL) and Cona Resource Ltd. would be over the 10,000 bpd threshold. If those four were curtailed 8.7 per cent, the cut would amount to a total of 10,696 bpd. Husky’s cut would be 7,677 bpd, Baytex would see 1,467, CNRL would see 1,027 and Cona would see 526 bpd in production cuts.

As of Dec. 3, Husky Energy, Saskatchewan’s largest heavy oil producer, had the most drilling rigs working in the country, at 16. Ten of those were in Saskatchewan, principally working on their SAGD thermal operations which are designed to each produce 10,000 bpd.

��

See related story:��