Calgary – Baytex Energy Corp., long a prominent player in the heavy oil region near Maidstone, has scooped up Raging River Exploration Inc., a prominent player in the Viking play near Kindersley, in a $2.8 billion all-stock deal, announced on June 18.

The combination creates a company with a $5 billion enterprise value, and five major core areas, two of which, the Viking and Lloydminster areas, are in Saskatchewan. Its combined production is expected to be over 100,000 boepd in 2019.

The transaction will result in holders of common shares of Raging River receiving, directly or indirectly, 1.36 common shares of Baytex for each Raging River share owned. The exchange ratio was determined based on the market trading levels of the Baytex shares and Raging River shares at the time the companies entered into exclusive negotiations. The board of directors of Baytex and the board of directors of Raging River have unanimously approved the transaction and have received fairness opinions from their respective financial advisors.

The transaction is subject to approval by the shareholders of both companies, the Court of Queen’s Bench of Alberta and certain regulatory and other authorities, and is subject to the satisfaction or waiver of other customary closing conditions. The transaction is anticipated to close in August 2018.

Neil Roszell, executive chairman and chief executive officer of Raging River, will serve as chairman and Edward LaFehr, president and chief executive officer of Baytex, will serve as president and CEO of the combined company. The balance of the senior management of the combined company will incorporate senior individuals from both Baytex and Raging River. The board of directors of the combined company will consist of members of both the Baytex Board and the Raging River Board with Raymond Chan serving as lead independent director.

In a press release, Roszell said, “We are uniting two strong oil companies with exceptional people and assets. This combination creates a diversified, well-capitalized oil producer that has an impressive suite of high quality producing assets and the ability to materially advance our East Duvernay Shale light oil opportunity, while continuing to develop our Eagle Ford, Viking, Peace River and Lloydminster core assets. The combination provides a substantial value proposition for all shareholders of Raging River and Baytex incremental to what each company could deliver on its own. The combination with Baytex is an excellent outcome to the comprehensive strategic process undertaken by the Raging River Board.”

LaFehr said, “We believe the combined company will deliver a powerful combination of industry-leading returns, attractive production growth and strong free cash flow generation. The merger creates a company with world class assets and a strong balance sheet while retaining substantial torque to higher crude oil prices. We will be well-positioned to optimize our capital investment program across our high rate of return asset base. The combined company has a dominant 260,000 net acre position in the emerging East Duvernay Shale oil play which has the potential to compete for capital with the best plays in North America.”

“I’m really excited to unleash this new, powerful combination of assets and people, that share a highly aligned strategy, and culture of operational excellence and innovation. Our vision is to build this top-tier North American oil company through disciplined growth and returns to shareholders. The new company will be a self-funded business model, focused on per share growth, targeting a 10 to 15 per cent total return to shareholders, while driving our net debt to adjusted funds flow ratio down to 1.5 times,” LaFehr said.

He promised accelerating activity, particularly in the East Duvernay, and accretive acquisitions, and mitigating its decline rate to less than 30 per cent over time.

Roszell said in the conference call, “This is a truly compelling combination that creates an even stronger company. It’s better positioned for value creation, well beyond what either of our companies could do on a stand-alone basis.”

A day after the announcement, Raging River had five rigs working in the Viking play near Kindersley, and one in the East Duvernay play near Pembina. Those six rigs put it in fifth place nationally for the number of active drilling rigs.

Background

Raging River’s May 14 press release noted the company’s average daily production for the first quarter of 2018 was 24,188 boepd, (93 per cent oil) and it had drilled 126 gross (112.7 net) wells during that time with a 100 per cent success rate. It had also drilled a Duvernay light oil discovery well in the Pembina (Pigeon Lake) area of central Alberta.

Raging River started operations in 2012. Headed by Roszell, Saskatchewan’s 2015 Oilman of the Year, it had initially planned to sell in its early years, but that plan was derailed when the oil downturn hit in 2014. In July 2016, the company was talking about plans for spending $3 billion in capital expenditures in Saskatchewan over the next 10 years, and a further $1 billion in operational expenses.

However, things have changed since then. As the oil industry has improved, in March the company has said it was initiating a process to review its strategic positioning. In a March 5 press release, the company said, “In connection with the repositioning process, the board intends to undertake a comprehensive review to identify and consider a broad range of alternatives to enhance shareholder value, including, but not limited to, a merger, corporate sale, corporate restructuring, the sale of select assets, the purchase of assets, or any combination of the potential alternatives.”

The company has long been one of the most active drillers in the Saskatchewan Viking play, often running neck-and-neck with Teine Energy Ltd., the other significant operator in that area. In July 2016, when much of the oilpatch was in its greatest slump in recent years for drilling, Raging River placed fifth on the top five active operators list for the entire country on June 7, with three drilling rigs working.

At the time, Roszell attributed that to their shallow wells taking only 2.5 days from spud to release.

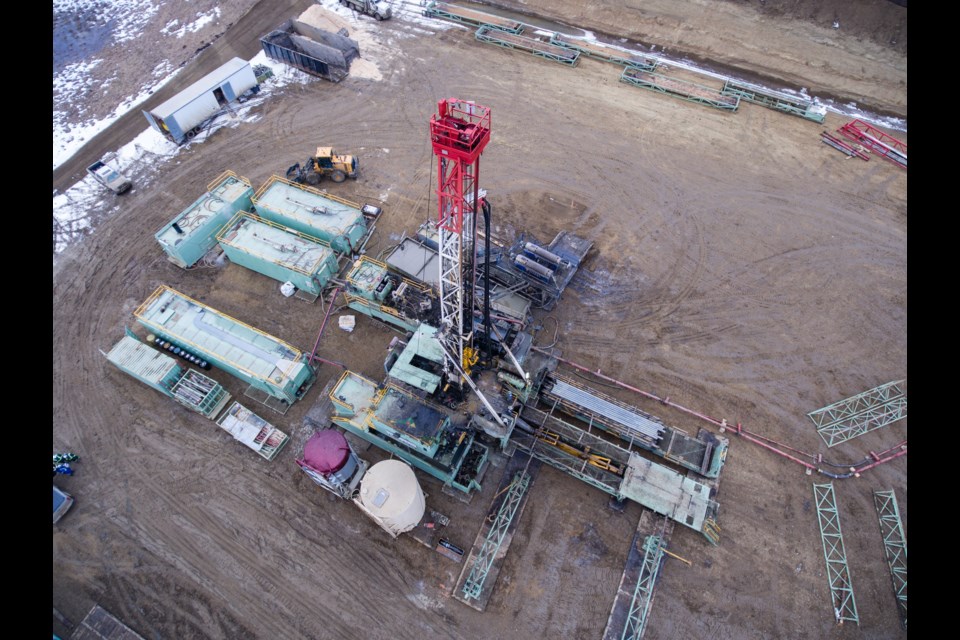

Baytex has a history in Saskatchewan spanning over 20 years, in particular in their Soda Lake field, south of Maidstone. When Pipeline Newsvisited this field in February 2017, they had one rig drilling multilateral wells, and one of their main methods of production is waterflood enhanced oil recovery. Baytex’s June 2018 presentation, which came out with the merger announcement, said they have two rigs working in that area and intend on continuing that into 2019.

The combined company will have an estimated average annual production of 100,000 to 105,000 boepd, of which 85 per cent will be oil and natural gas liquids. Their exploration and development capital program will be between $750 to $850 million, representing a five to 10 per cent production growth.

During the conference call, LaFehr noted expansion in the East Duvernay and Lloydminster heavy oil regions and using the Viking and Eagle Ford for free cash flow.

Eagle Ford

Baytex has 36,000 boepd (78 per cent oil and NGL) in the south Texas Eagle Ford play. Wells that commenced production in the first quarter of this year were bringing in approximately 1,750 boepd per well, a 20 per cent improvement from wells a year before. Two wells produced approximately 2,400 boepd in their initial 30 days of production.

East Duvernay

Their East Duvernay region, which from Ponoka to Sylvan Lake, then north to Pigeon Lake and back to Ponoka, was a highlight of the deal. Raging River holds a 100 per cent working interest in greater than 260,000 net acres of lands in the emerging East Duvernay Shale oil play in central Alberta. The release noted the Duvernay is among the largest oil and gas resources in Western Canada with activity in the east shale basin increasing over the last three years in pursuit of light oil (average 36-42° API). During the first quarter of 2018, Raging River embarked on a three well evaluation program, which included an initial discovery in the Pembina area that has produced at an average rate of 430 boepd (88 per cent light oil and NGLs) in its first 80 days since coming on production on March 23, 2018. The well continues to produce at strong rates with the last seven days averaging 400 boepd (88 per cent light oil and NGLs). Given the success of the exploration program, four additional locations are С����Ƶ licensed offsetting the discovery well in preparation for an expanded capital program in the second half of 2018 and a 2019 plan that will include 12-20 net wells.

Viking

In the Viking, Raging River has built a dominant position in the Viking light oil resource play in western Canada with over 460 net sections of highly prospective land and approximately 10 years of drilling inventory at the current pace of development. Production in the Viking averaged 23,000 boepd in the first quarter of 2018 (approximately 36° API). The Viking generates an exceptional operating netback of approximately $44/boe at a WTI price of US$65/bbl with well payouts averaging approximately 10 months.

Raging River currently has four drilling rigs running and anticipates a continuous program through year end. The Viking extended reach horizontal results continue to exceed expectations with multiple new, previously untested sections С����Ƶ proven as economically drillable during the first quarter. The Viking is expected to continue to generate significant free cash flow in the current commodity price environment. Waterflood initiatives continue to advance with continued positive results at Gleneath, Eureka, Plato and Forgan.

Peace River

The Peace River region, located in northwest Alberta, has been a core asset for Baytex since operations commenced in the area in 2004. Through innovative multi-lateral horizontal drilling and production techniques, Baytex’s Peace River properties generate strong capital efficiencies. Baytex’s recent northern Seal well (13-leg multi-lateral) generated a 30-day initial production rate of 900 boepd (facility constrained); a total of 10 wells are anticipated to be drilled in the area in 2018. Production averaged 16,500 boepd (90 per cent heavy oil) in Q1/2018. Baytex has a dominant land position of 725 net sections and an inventory of approximately 350 drilling locations that generate 50 per cent to 75 per cent IRRs at a WTI price of US$65/bbl. Baytex expects to have two rigs running in the second half of the year as it continues to build operational momentum heading into 2019.

This area will see an increased two-rig drilling program through 2019.

Lloydminster

Baytex’s Lloydminster region is characterized by multiple stacked pay formations at relatively shallow depths. The area has been successfully developed through vertical and horizontal drilling, water flood, steam-assisted gravity drainage operations and, more recently, the implementation of polymer flooding to further enhance reserves recovery. Baytex has adopted, where applicable, the multi-lateral well design and geosteering capability it has successfully utilized in Peace River. Lloydminster drilling locations generate 50 per cent to 110 per cent IRRs at a WTI price of US$65/bbl. Production averaged 10,000 boepd (99 per cent heavy oil) in Q1/2018. Baytex will recommence its Soda Lake multi-lateral drilling program in June and expects to have two rigs running in the second half of the year.