Calgary – It took a while, but Crescent Point Energy Corp. announced on Sept. 3 that it had sold approximately 7,000 barrels of oil equivalent per day production of its conventional assets in southeast Saskatchewan, and more significantly, its entire Utah-based Uinta basin assets totalling 20,000 boepd.

And it’s not done yet. In a release on Sept. 3, the company said it continues to pursue additional asset sales, including the balance of its southeast Saskatchewan conventional assets, and the monetization of its Saskatchewan gas infrastructure assets, the process for which continues to progress.

“Since we established our transition plan in September 2018, we have meaningfully improved the sustainability of our business model by revising our capital allocation process, lowering our cost structure and strengthening our balance sheet,” said Craig Bryksa, president and CEO of Crescent Point. “The sale of the Uinta Basin and certain conventional assets is accretive for our shareholders and aligned with the key criteria we established for our asset portfolio. These transactions are a considerable step forward in our ongoing plan to focus our asset base.”

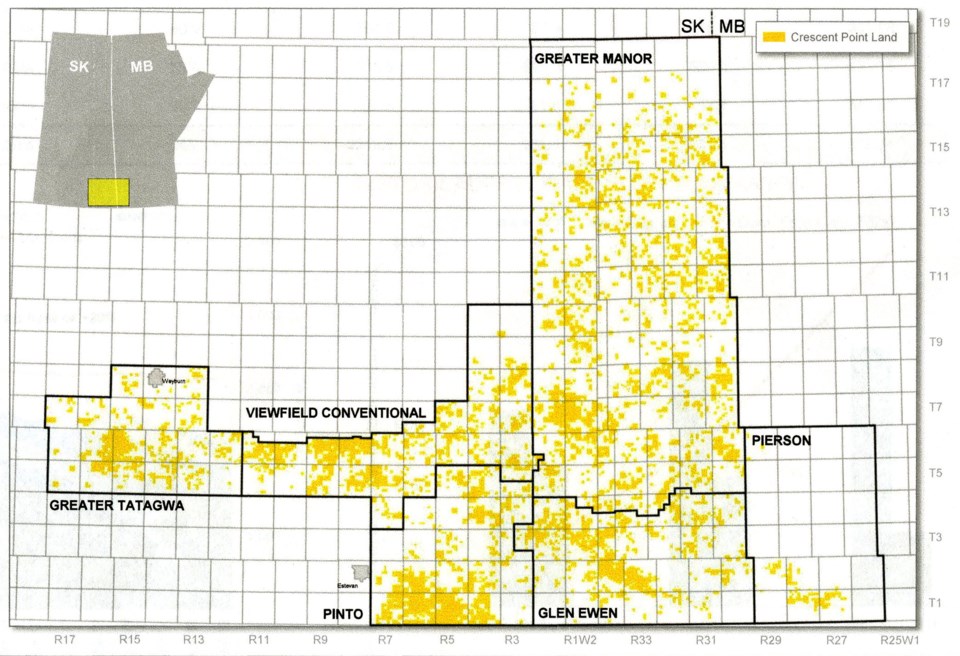

On May 20, Pipeline Newsreported details of the asset sale in southeast Saskatchewan, which listed approximately 21,625 barrels of oil equivalent per day (boepd) of predominantly Mississippian light oil for sale, with over 100 mmboe of 2P reserves across approximately 800 net sections of land. The Sept. 3 announcement appears to account for approximately one-third of the southeast Saskatchewan and southwest Manitoba assets that were detailed in the company’s “С����Ƶeast Saskatchewan Light Oil Portfolio Offering” of early 2019.

That offering broke down the portfolio into six parcels, five in southeast Saskatchewan, and one in the extreme southwest corner of Manitoba, referred to as “Pierson.” Basically, almost everything east of Highway 47, except for part of the Viewfield Bakken around Forget and Kisbey, was for sale. There was also a portion south of Weyburn.

The maps included in the documents showed that pretty much everything in southeast Saskatchewan that is not part of the Viewfield Bakken of Flat Lake plays up for grabs.

Pipeline News has requested further details on the dispositions, but has not yet received any. This story will be updated as further details are received.

С����Ƶeast Saskatchewan

The conventional assets С����Ƶ sold include approximately 7,000 (boepd) of current production (70 per cent crude oil and 85 per cent total liquids) and 49.2 million boe (MMboe) of proved plus probable (2P) reserves. These reserves are based on the company's independent engineers' evaluation and price forecast as at December 31, 2018.

The total price came in at $212 million.

These conventional assets operate with a higher operating cost structure and generate an operating netback that is approximately 30 percent below Crescent Point's corporate average. Additionally, the future decommissioning liabilities associated with these non-core assets are higher than those associated with the company's key focus areas, Crescent Point said in a release.

The transaction metrics are approximately as follows:

- 4.5 times 2020 cash flow at current strip prices, based on an operating netback of $18.55 per boe;

- $30,000 per producing boe; and

- $9.80 per 2P boe, including FDC of approximately $270 million, as assessed by independent engineers.

National Bank Financial Inc. and Scotiabank acted as Crescent Point's financial advisors for these transactions. The agreements are expected to close late third quarter 2019, subject to the satisfaction of typical closing conditions and regulatory approvals.

Uinta Basin Disposition

During first quarter 2019, Crescent Point initiated a sales process for its Uinta Basin asset, an area that the company had characterized on its website as an “emerging and early stage growth play.”

This process has resulted in the successful execution of a purchase and sale agreement to sell the entirety of the company's Uinta Basin position to a private operator for total cash consideration of approximately $700 million (US$525 million), before closing adjustments.

Crescent Point's Uinta Basin asset includes approximately 350 net sections of undeveloped land, 123.1 MMboe of 2P reserves and 29.5 MMboe of proved developed producing (PDP) reserves. These reserves are based on the company's independent engineers' evaluation and price forecast as at December 31, 2018.

Based on the above expectations and approximately 20,000 boepd (75 per cent crude oil and 85 per cent total liquids) of forecast production in 2020, before royalties, the transaction metrics are approximately as follows:

- 4.8 times cash flow at current strip prices, based on an operating netback of $20.05 per boe;

- $35,000 per producing boe;

- $16.75 per 2P boe, including future development capital (FDC) of approximately $1.36 billion, as assessed by independent engineers; and

- $1,300 per acre of undeveloped land or $3,100 per acre of undeveloped land with recognized drilling locations, net of PDP reserves value of $404 million using independent reserves at current strip pricing.

Crescent Point expects to generate improved corporate returns and a stronger operating netback from lower royalties and reduced expenses as a result of this disposition. The capital expenditures required to sustain the company's annual production are also expected to improve due to a shallowing of the corporate decline rate.

BMO Capital Markets and CIBC Capital Markets acted as Crescent Point's financial advisors on this transaction and each provided a fairness opinion to the board of directors, subject to the assumptions, qualifications and limitations contained therein. Tudor, Pickering, Holt & Co. represented the Company as its strategic advisor. The sale is expected to be completed in October 2019, subject to the satisfaction of normal closing conditions and the receipt of regulatory approvals.

Transition plan

In September 2018, new management established a transition plan centered on its key value drivers of disciplined capital allocation, cost efficiencies and balance sheet improvement. The company said it has successfully shifted its corporate strategy and capital allocation process, realigned its focus on generating stronger returns, realized cost improvements throughout the organization and materially enhanced its financial flexibility.

Including the Sept. 3 announcement, Crescent Point has now executed a total of over $1.3 billion in asset dispositions since the change in senior management and approximately $975 million of asset dispositions in 2019 alone.

Broader details

Crescent Point’s net debt is expected to improve to approximately $2.75 billion at year-end 2019, down from $4.40 billion prior to the changes in senior management in 2018. These transactions strengthen balance sheet and lower pro-forma net debt to adjusted funds flow ratio by approximately 0.4 times.

The deals are accretive to debt-adjusted funds flow per share by approximately 11 percent, while also improving the corporate operating netback by approximately five percent, lowering the capital required to sustain annual production and enhancing the Company's financial flexibility.

They increase Crescent Point's ability to continue executing its share repurchase program, with approximately $100 million of incremental share repurchases budgeted for the remainder of 2019, based on guidance at current strip prices.

The company will continue to advance disciplined disposition program, including the monetization of certain infrastructure assets.

Updated 2019 guidance

Crescent Point's revised guidance for 2019 incorporates the announced asset dispositions and includes annual average production of 160,000 to 164,000 boe/d. The Ccmpany's capital expenditures of $1.2 to $1.3 billion remains unchanged based on the planned spending profile for the disposed assets during the remainder of the year, as previously budgeted.

Crescent Point expects to conclude its 2019 capital expenditures budget for its Uinta Basin asset during September 2019. This program includes the fracture stimulation and completion of a number of previously drilled two-mile horizontal wells as part of the company's multi-well pad development program. Crescent Point expects these eight (seven net) two-mile horizontal wells to be brought on-stream prior to the transaction closing in late third quarter, resulting in forecast production of over 22,000 boepd from the asset at closing.

The company's original 2019 budget allocated approximately $150 million in total to its Uinta Basin asset in comparison to approximately $200 million of estimated capital required to sustain annual production of approximately 20,000 boepd in 2020. The southeast Saskatchewan conventional assets С����Ƶ sold would require estimated capital of approximately $25 million to sustain annual production of approximately 7,000 boepd in 2020. As a result of these dispositions, the required capital expenditures to sustain annual production, as a percentage of Crescent Point's cash flow, is expected to improve.

The company's revised 2019 guidance also incorporates the impact of converting additional producing wells to waterflood injectors as part of its commitment to decline mitigation. Crescent Point is now targeting approximately 175 to 200 injection well conversions in 2019 compared to its original budget of approximately 145 conversions.

The company does not expect to incur any cash taxes resulting from the announced asset dispositions.

Share repurchases

As a result of its significant disposition program to date and enhanced free cash flow generation in 2019, Crescent Point's net debt and leverage ratios continue to improve, it said. Based on strip prices and the announced dispositions, total net debt is expected to be reduced to approximately $2.75 billion at year-end 2019, resulting in a pro-forma net debt to adjusted funds flow ratio that is lower by approximately 0.4 times.

The company said it is in a strong position to continue executing its share repurchase program in 2019 and currently budgets approximately $125 million for accretive share repurchases during the year, based on guidance at current strip prices. This implies approximately $100 million of incremental share repurchases during the remainder of 2019. Management will continually assess its allocation of excess cash flow, including additional share repurchases, as it further strengthens its balance sheet.

The company noted its current share price continues to trade at a significant discount compared to the fundamental underlying value of its common shares. The morning of the announcement it was trading at $4.25 on the TSX.

The announced asset dispositions are expected to be accretive by over 20 percent on a PDP basis to the company's net asset value per share, excluding land and seismic, based on current strip commodity prices. As a result of these transactions, Crescent Point expects to realize an after-tax loss on the sale, or impairment, within its third quarter 2019 financial results that equates to less than three percent of the value of its total net property, plant and equipment as at June 30, 2019.

Hedging

Based on the announced dispositions, Crescent Point expects approximately 49 percent of its oil and liquids production, net of royalty interest, to be hedged upon closing in fourth quarter and approximately 35 percent in 2020. The company said it will remain disciplined in its approach to layering on additional hedges, taking into account commodity prices and its ongoing asset disposition program.