Calgary – Baytex Energy Corp. joined its counterparts in announcing a newly revised capital expenditure program on March 18, cutting 50 per cent of its originally planned 2020 capital budget to $260 to $290 million, from the original $500 to $575 million announced on Dec. 4, 2019.

On the day of the announcement, Western Canadian Select hit the US$7 range

Ed LaFehr, president and chief executive officer, said in a release, “As an industry, we are facing an unprecedented challenge due to the significant degradation and volatility in global crude oil prices. During this time, our priority is to preserve financial liquidity. As a result, we are immediately suspending drilling operations in Canada and expect to see a moderated pace of activity in the Eagle Ford. In addition, we are proactively shutting-in low or negative margin heavy oil production in order to optimize the value of the resource base and maximize our adjusted funds flow. Our 2020 program will remain flexible and allows for adjustments to spending and production based on changes in the commodity price environment.”

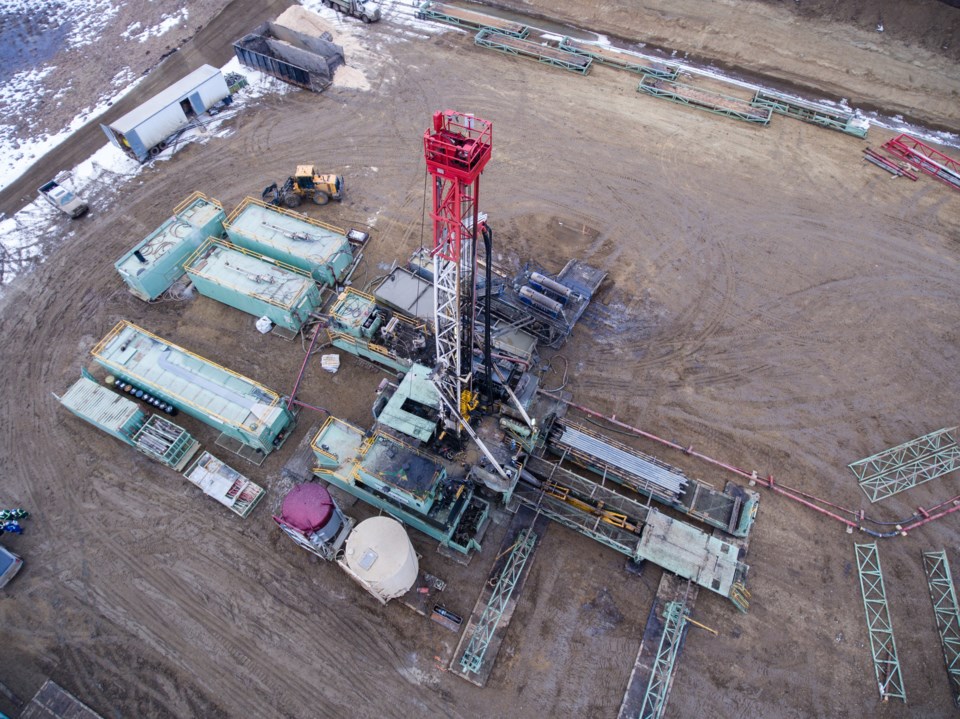

Baytex is a significant player in the Maidstone and Kindersley areas. It has produced in the Maidstone area for over 20 years, and in recent years purchased Raging River Exploration, which had been one of the key players in the Kindersley-area Viking play.

2020 Outlook

Baytex is immediately suspending drilling operations in Canada. As a result, the company expects to forgo drilling 43 net heavy oil wells and 151 net light oil wells over the balance of this year. In addition, the company expects a moderated pace of development in the Eagle Ford with 16 to 18 net wells brought on production (previously 22 net wells).

The company said in a release, “We now anticipate 2020 exploration and development expenditures of $260 to $290 million. At the mid-point, this reflects an approximate 50 per cent reduction in capital spending for 2020 relative to our initial expectation of $500 to $575 million. For Q1/2020, exploration and development expenditures are expected to be approximately $190 million, down $10 million from our original plan. Our 2020 program will remain flexible and allows for adjustments to spending based on changes in the commodity price environment.

“We are also proactively shutting-in approximately 3,500 boepd of low or negative margin heavy oil production in order to optimize the value of our resource base and maximize our adjusted funds flow. Should operating netbacks change, we have the ability to shut-in additional volumes or restart wells in short order.”

Taking into account the shut-in heavy oil volumes and a reduced capital program, Baytex has revised its production guidance range for 2020 to 85,000 to 89,000 boepd, from 93,000 to 97,000 boepd previously, representing an approximate 5 per cent reduction to its original guidance, excluding the impact of shut-in volumes.

Salary cut

“During this period, we will remain focused on driving further efficiencies in our operations. As a continued cost control measure, all full-time employee salaries and all annual retainers paid to our directors will be reduced by 10 per cent effective April 1, 2020,” the company said.

“The situation around the COVID-19 virus continues to evolve. We are focused on protecting the health and safety of our personnel while striving for business continuity. We have implemented a number of measures to foster resilience through these unpredictable times, including a work-from-home program. To date, we have had no operational or supply chain impacts from COVID-19.”

Financial Liquidity

Baytex recently extended the maturities of our credit facilities to April 2, 2024. The credit facilities are not borrowing base facilities and do not require annual or semi-annual reviews. Our facilities total approximately $1.1 billion and include US$575 million of revolving credit facilities and a $300 million term loan. Our credit facilities are approximately one-third undrawn with $300 million of liquidity. In addition, our first long-term note maturity of US$400 million is not until June 2024.

Risk Management

To manage commodity price movements we utilize various financial derivative contracts to reduce the volatility in our adjusted funds flow.

For 2020, Baytex entered into hedges on approximately 53 per cent of its net crude oil exposure. This is comprised largely of a 3-way option structure on 24,500 bpd that at current oil prices will see Baytex receive WTI plus US$7.60/bbl. and WTI-based fixed price swaps on 3,500 bpd at US$57.40/bbl.