It took a while, but Crescent Point Energy Corp. announced Tuesday that it had sold approximately 7,000 barrels of oil equivalent per day (boepd) production of its conventional assets in southeast Saskatchewan, along with its entire Utah-based Uinta basin assets totalling 20,000 boepd.

And it’s not done yet. In a release on Sept. 3, the company said it continues to pursue additional asset sales, including the balance of its southeast Saskatchewan conventional assets, and the monetization of its Saskatchewan gas infrastructure assets, the process for which continues to progress.

“Since we established our transition plan in September 2018, we have meaningfully improved the sustainability of our business model by revising our capital allocation process, lowering our cost structure and strengthening our balance sheet,” said Craig Bryksa, president and CEO of Crescent Point.

“The sale of the Uinta Basin and certain conventional assets is accretive for our shareholders and aligned with the key criteria we established for our asset portfolio. These transactions are a considerable step forward in our ongoing plan to focus our asset base.”

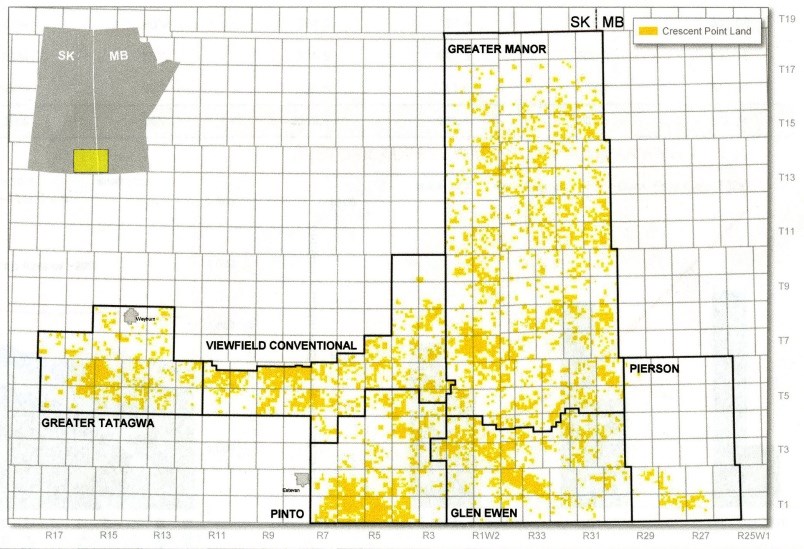

On May 20, Pipeline News reported details of the asset sale in southeast Saskatchewan, which listed approximately 21,625 boepd of predominantly Mississippian light oil for sale, with over 100 million boe of 2P reserves across approximately 800 net sections of land. The Sept. 3 announcement appears to account for approximately one-third of the southeast Saskatchewan and southwest Manitoba assets that were detailed in the company’s “С����Ƶeast Saskatchewan Light Oil Portfolio Offering” of early 2019.

That offering broke down the portfolio into six parcels, five in southeast Saskatchewan, and one in the extreme southwest corner of Manitoba, referred to as Pierson. Basically, almost everything east of Highway 47, except for part of the Viewfield Bakken around Forget and Kisbey, was for sale. There was also a portion south of Weyburn.

The maps included in the documents showed that pretty much everything in southeast Saskatchewan that is not part of the Viewfield Bakken of Flat Lake plays up for grabs.

The conventional assets С����Ƶ sold include approximately 7,000 (boepd) of current production (70 per cent crude oil and 85 per cent total liquids) and 49.2 million boe (MMboe) of proved plus probable (2P) reserves. These reserves are based on the company's independent engineers' evaluation and price forecast as at Dec. 31.

The total price came in at $212 million.

These conventional assets operate with a higher operating cost structure and generate an operating netback that is approximately 30 per cent below Crescent Point's corporate average. Additionally, the future decommissioning liabilities associated with these non-core assets are higher than those associated with the company's key focus areas, Crescent Point said in a release.

The transaction metrics are approximately as follows:

- 4.5 times 2020 cash flow at current strip prices, based on an operating netback of $18.55 per boe;

- $30,000 per producing boe; and

- $9.80 per 2P boe, including FDC of approximately $270 million, as assessed by independent engineers.

National Bank Financial Inc. and Scotiabank acted as Crescent Point's financial advisors for these transactions. The agreements are expected to close late third quarter 2019, subject to the satisfaction of typical closing conditions and regulatory approvals.

For more on this article, please visit www.pipelinenews.ca.