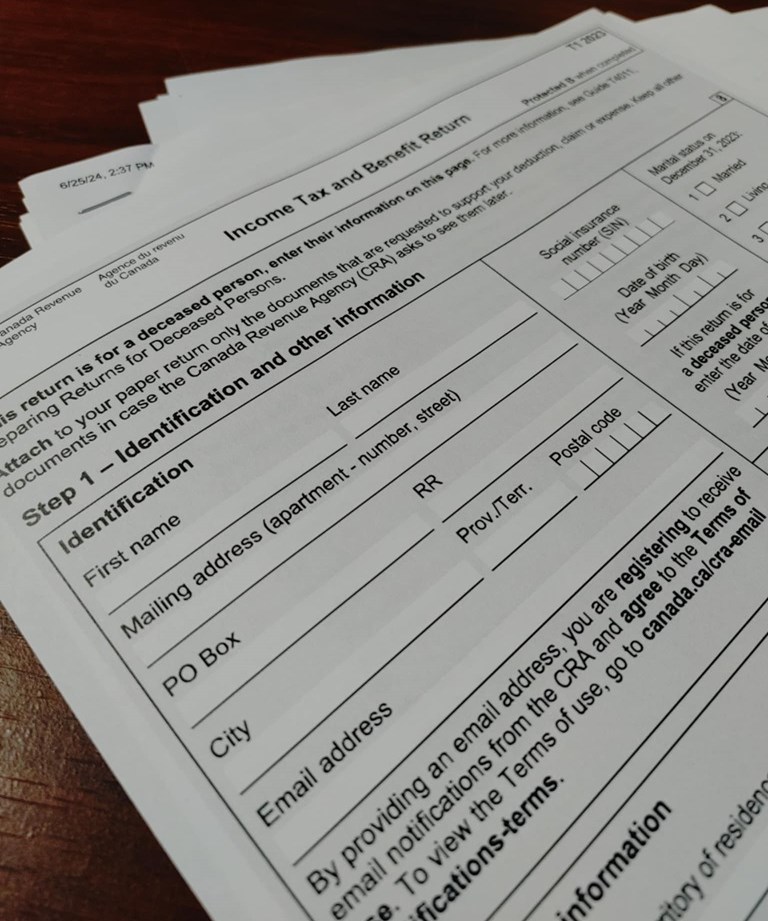

SASKATCHEWAN — Some people are getting frustrated with how the Canada Revenue Agency (CRA) has changed the way things are done.

One Unity farmer received two Notice of Assessments, one for his personal taxes and the other for a co-operative he is involved with. Both pages showed a $100 deduction, with the description of ‘Failure to file electronically’ as the reason for the deduction. So why is this deduction С����Ƶ applied?

According to the CRA, all GST/HST registrants, with exception of charities and selected listed financial institutions, were required to file their returns electronically for any reporting periods that begin after Dec. 31, 2023.

Those who choose to not file their returns electronically are now subject to some penalties. For the first return that is not filed electronically, the registrant will be penalized $100. If the registrant still does not file electronically, they will be penalized $250 for each subsequent return that is submitted by paper.

Letters were sent to those who preferred to file by paper, advising them the mandatory electronic filing threshold had been removed. Paper filers were now obligated to file electronically and the required access code was included with their filing packages.

The penalty will apply even if the GST/ HST return is a nil or a credit return. For registrants who file annually, this will only apply to 2024 returns that are due in 2025.

What are the benefits of filing online?

While there are many benefits of filing online, one of the biggest benefits is saving time and money for both the recipient and the CRA. Recipients are able to confirm their tax information sooner, which results in receiving their refunds and credits much faster than by mail.

The CRA also says filing online is much safer and more secure than by mail. They use secure networks for data, where paper processing is more vulnerable to errors and disruptions.

No computer? No problem

Although the CRA has received feedback regarding those who do not have access to a computer or reliable internet, the GST/ HST TeleFile is still available. Filers use a touchtone phone and an access code to file their returns. If this is still not a viable solution, a written request to continue paper filing can be sent to the Atlantic Tax Centre.

Filers can also seek the expertise of their local accountants as many are able to help with filing returns electronically.